NKSFBTax Insights

A New Year Means New Tax Figures For Individuals

January 13, 2026

Many tax figures are annually adjusted for inflation and typically increase each year (or at least every few years).

Read More about A New Year Means New Tax Figures For IndividualsSubscribe to

Tax Insights

Receive the latest Tax Insights post, delivered directly to your inbox.

There’s Still Time To Save 2025 Taxes

December 29, 2025

Just because it’s December doesn’t mean it’s too late to reduce your 2025 tax liability. Consider implementing one or more of these year-end tax saving ideas by December 31.

Modernizing Payments To And From America’s Bank Account

December 3, 2025

the U.S. Department of the Treasury, in coordination with the Internal Revenue Service and other federal agencies, is advancing the transition to fully electronic federal payments.

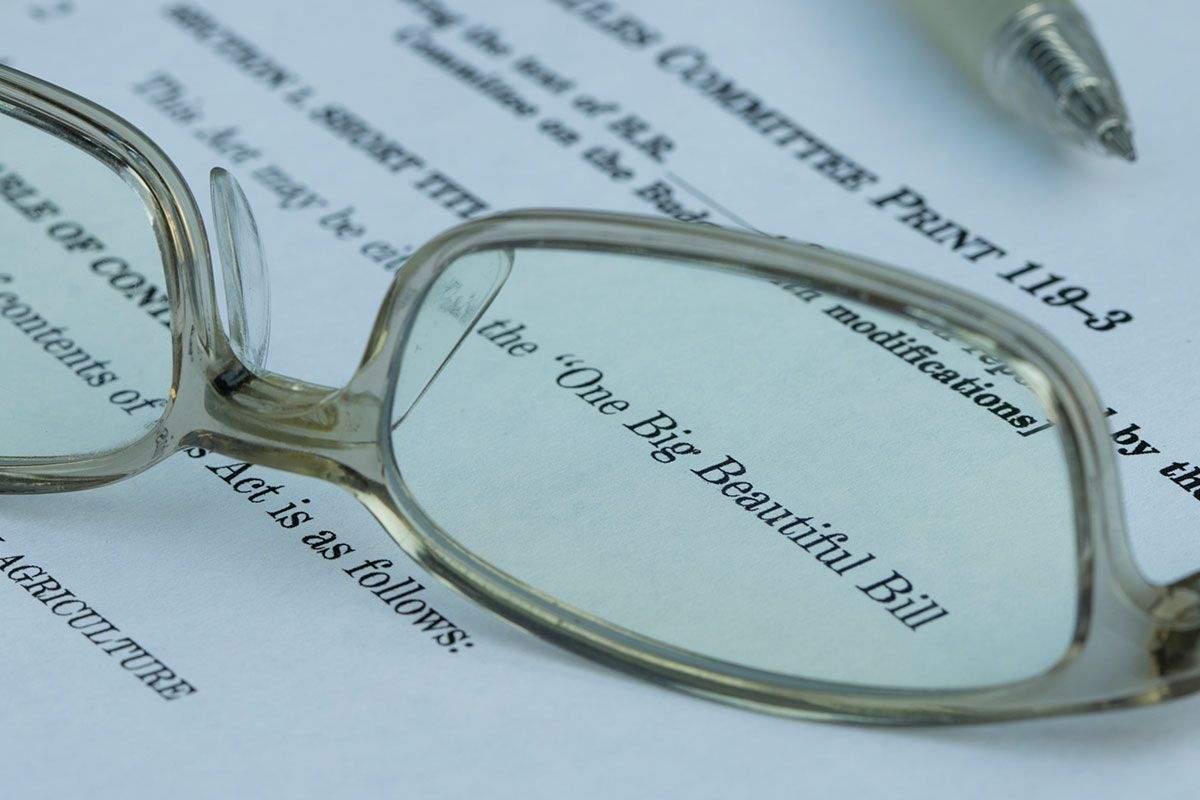

One, Big, Beautiful Bill Act – Individual Provisions

July 31, 2025

The One, Big, Beautiful Bill Act (OBBBA) includes, among many other things, numerous provisions that can affect an individual’s taxes.

One, Big, Beautiful Bill Act: Business Provisions

July 17, 2025

The One, Big, Beautiful Bill Act (OBBBA) includes numerous provisions affecting the tax liability of U.S. businesses.

The One, Big, Beautiful Bill Act

July 11, 2025

On July 4, President Trump signed into law the far-reaching legislation known as the One, Big, Beautiful Bill Act (OBBBA). As promised, the tax portion...

Exploring Business Entities: Is an S Corporation the Right Choice?

May 12, 2025

Are you starting a business with partners and deciding on the right entity? An S corporation might be the best choice for your new venture.